Open-Loop Transit Payments Summary

30 minutes Author: Al Benedict, Director of Accessibility Programs, SUMC and Hani Shamat, Senior Program Coordinator, SUMC Date Launched/Enacted: Apr 2, 2025 Date Published: April 2, 2025

Open-loop payment systems allow transit riders to pay for their trip directly using a debit or credit card or digital wallet. Unlike proprietary fare mediums connected to accounts within closed systems, open-loop loop payment systems enable direct transactions between various accounts and financial institutions (most commonly, a customer’s bank and a merchant’s bank). In an open-loop system, a traveler does not need to link a transit account with a bank account or load a farecard with value, but can simply tap their own bank or credit card on a contactless reader to pay. Transit agencies worldwide are implementing open-loop payment technology and exploring how they can make public transit more convenient, accessible, flexible, and similar to what many customers already experience in retail settings.

What are open-loop payments?

An open-loop payment is any widely accepted digital payment method where the entity issuing the form of payment is different from the entity accepting it. Open-loop payment systems are generally understood to be debit or credit accounts typically issued by a bank, tied to a consumer bank account. Open-loop payments are agnostic to any particular financial institution and allow for a variety of payment methods, like debit cards, credit cards, or bank card-enabled smartphones or smartwatches. By this definition, cash could be considered an open-loop payment within any particular country, but the term more commonly refers to systems like debit and credit accounts issued by financial institutions, typically via a card. These cards and accounts are generally enabled across the payment networks built and maintained by companies such as Visa, Mastercard, JCB, or Discover. Merchants and consumers around the world have long relied on these systems as a more convenient method of payment than cash.

The open-loop payment model is different from a closed-loop payment model that transit agencies have historically used. A closed-loop payment system is affiliated with a particular merchant, or in the case of public transit, a specific transit system and a particular, proprietary technology. A closed-loop system will only accept payment from its own pre-loaded card or mobile app; the card or app, in turn, can only be used for payments on that system. For example, Metro Transit in Saint Paul and Minneapolis, Minnesota uses a contactless Go-To Card or the Metro Transit mobile app, both of which are closed-loop, proprietary, and connected to user accounts issued within Metro Transit’s system.

Contactless payments

Credit: SUMC

Contactless payment technology is now in wide use commercially. Rather than swiping or inserting a card into a point-of-sale terminal, contactless payments allow users to tap a card or mobile phone on the terminal, which uses Near Field Communication (NFC) technology to initiate the transaction. In a transit context, this allows riders to tap to pay their fare onboard a bus or directly at a faregate with the same card and motion they might use to pay for a cup of coffee. Contactless technology that runs on card payment organizations’ payment networks is needed to accommodate Apple Pay, Google Pay, Samsung Pay, or other payment methods in mobile devices like smartwatches and smartphones. Collectively, contactless debit or credit cards, mobile wallets, and the software and hardware technologies that accept payments from these methods are all certified on the contactless Europay Mastercard Visa (cEMV) standard. When the user is within a set distance from the contactless payment reader, the payment is digitized using a token representing the payment account. The token adds a layer of security to the transaction as the bank card number and other personal information are not transmitted.

Contactless payments eliminate the need for a transit user to purchase a paper ticket, transit card, or digital ticket, or to add a transit card account to their mobile wallet. The physical equipment needed by the transit agency, other than access to the internet, are point of sale terminals installed on each vehicle or entry/departing access point, depending on the agency’s preferred payment location. Software to charge the correct price is also needed, and all of the vendors involved in the transaction must adhere to payment card industry data security standards and be certified by the payment networks.

For the purposes of this paper, however, the term open-loop payment system refers to contactless digital payment technologies like bank cards or mobile-enabled digital bank cards that are nearly ubiquitous in retail and are accepted around the world. Unless otherwise noted, open-loop payment, open payments, and contactless open-loop payment are used interchangeably.

Types of open-loop payment systems

Transit operators have deployed three models of open-loop payment:

- The Known Fare Model: with this model, the value of the transaction is charged when the rider taps their card at the validator. The Known Fare Model applies a fixed fare each time a transaction is made, so it is most appropriate for transit agencies operating with flat fares rather than zone-based or distance-based fares. The Known Fare Model can work well for simple systems, where exact fares are always known ahead of time, and payment authorization can happen relatively quickly.

- Accumulated Model (also known as the Aggregation Model): this method defers the transaction and charges the rider after the trip has been taken. This model works for systems where the purchased fare is unknown at the start of a journey, like zone-based or distance-based fare structures. A passenger taps both when entering and exiting a transit system, and the fare is calculated and charged afterward, typically at the end of the trip or at the end of the day.

- Card as Credential (Pre-Purchase) Model: with this model, a payment method is associated with a customer’s pre-purchased ticket or pass. When the customer uses the payment method at a transit terminal, the card is recognized as a credential to travel, allowing that customer to access the transit service.

Development and spread of open-loop payment systems

Open-loop contactless payments gained traction globally around 2010 and their use accelerated in the US during the COVID-19 pandemic, when it became commonplace to pay for retail and other services using contactless technology. Transport for London (TfL) was the first transit agency to deploy an open-loop contactless payment solution, allowing for payment by any type of open-loop payment card or device (e.g. a mobile-enabled digital wallet that stores a token of a payment card). TfL began its open-loop payment system in 2012, allowing customers to pay with their own contactless cards on buses, and rolled it out to the entire system two years later. By the Summer of 2015, open-loop payments eclipsed London’s closed-loop Oyster card. As of 2019, Londoners and visitors paid for 22 million trips per week (approximately half of all rides) with their own cards. One in eight of those trips was paid using a digital wallet.

Unlike in Europe, where transit services lead contactless adoption, in the US, the rise in contactless payments is connected to retail, food, and beverage merchants. In 2020, more than 20% of credit card payments in the US were made using contactless cards, a stark difference compared to 2018, where Visa reported less than 1% of transactions were made contactlessly across the Visa payment network. Another factor driving wider adoption in the US was Mastercard and Visa’s 2015 deadline for retailers to upgrade terminals to accept contactless payment, or risk being liable for fraud, as contactless payment is more secure than swiping a magnetic stripe.

Where are open-loop payments made in the US?

In the US, open-loop payments are most common in medium to large cities. This is almost exclusively due to the rate of issuance of contactless cards by US banks. The large US banks completed their rollout of contactless cards by the end of 2022, whereas many regional and community banks and credit unions issued theirs later, in part because contactless cards are more expensive to issue than magnetic stripe cards. Most point-of-sale terminals in the US were also contactless-ready by 2015 when Visa and Mastercard required chip card readers. The difference between a chip point-of-sale terminal and a contactless-ready terminal is an overnight software upgrade, rather than new hardware.

Though some US transit systems support open-loop payments, currently no systems are exclusively open payment. Most are hybrid systems that maintain closed-loop payment options, offer a mobile app, and/or continue to accept cash. For example, the Chicago Transit Authority (CTA) has an open-loop contactless payment system, so riders can pay for boarding a bus or elevated train using any open-loop card or mobile bank card-enabled device. However, the CTA also maintains its Ventra card system and associated vending hardware, a reusable closed-loop card that can only be used to pay for CTA or Pace Suburban Bus rides. Table 1 provides examples of large agencies in the US that have implemented or plan to implement open-loop payment systems, including CTA, as well as details on system rollouts and annual ridership.

Table 1: Large Transit Agency Examples

| Agency | Launch Date | 2022 NTD Unlinked Passenger Trips | Summary |

| Chicago Transit Authority (CTA) | August 2013 | 243.5 million | CTA added open-loop payments as well as payments through the agency-proprietary Ventra card. |

| New York Metropolitan Transit Authority (MTA) | Designed/implemented in 2017 (with earlier pilot iterations) | 2.3 billion | MTA’s contactless fare system, OMNY, supports payments from bank cards and bank card-enabled smartphones, and smartwatch wallets. MTA is in the process of phasing out MetroCard. With the issuance of the closed-loop OMNY card, MTA will be a fully contactless payment system, though not a fully open-loop system. However, this is an ongoing process and no date is currently set. |

| Tri-County Metropolitan Transportation District of Oregon (TriMet) | 2017 | 49.6 million | TriMet began accepting open payments in 2017. In 2024, TriMet expanded its Hop Fastpass fare capping benefits to open payments via bank cards and mobile wallets. |

| Miami-Dade Transit (MDT) | 2019 | 56.1 million | MDT introduced open-loop payment options for its transit system in 2019 |

| Dallas Area Rapid Transit (DART) | September 2021 | 41.3 million | DART added open-loop payments beginning in 2021, partially in an effort to increase ridership during the COVID-19 pandemic using contactless payments. |

| Southeastern Pennsylvania Transportation Authority (SEPTA) | September 2023 | 174.2 million | In September 2023, SEPTA rolled out contactless open-loop payment options on all transit modes, following a pilot earlier in the summer. |

| Massachusetts Bay Transportation Authority (MBTA) | August 2024 | 203 million | MBTA launched open payments on buses, trolleys, and subways. MBTA uses a hybrid system allowing riders to use open-loop bank cards and bank card enabled smartphone and smartwatch wallets, as well as MBTA’s closed-loop CharlieCard. |

| San Diego Metropolitan Transit System (MTS) | Summer 2024 | 57.6 million | MTS was the first large urbanized area agency in California to launch open-loop payments. Open payments were originally targeted at occasional riders, but MTS hopes to have its back office support fare capping which is currently only available through the agency’s closed-loop Pronto card. |

| Metropolitan Atlanta Rapid Transit Authority (MARTA) | Planned for 2026 | 51.4 million | MARTA is in the process of updating its fare collection system, and will be able to accommodate open-loop payments for all buses, trains, and streetcars. |

| Bay Area Regional Transit (BART) | In progress | 38.2 million | In November 2023, BART announced plans to launch open-loop payments in summer 2024, as part of an account-based fare system rollout. The system will also support an updated closed-loop Clipper card that functions in mobility wallets, like Apple or Google Pay, provided the closed-loop Clipper card is linked to the mobility wallet account. As of this writing, BART has not yet implemented open-loop payments. |

| Washington Metropolitan Area Transit Authority (WMATA) | Planned for 2025 | 156.9 million | WMATA began transitioning to open-loop payments in 2021, and plans to roll out full open-loop contactless payments in May 2025. |

| Los Angeles County Metropolitan Transportation Authority (LA Metro) | Planned for 2026 | 254.7 million | LA Metro plans to roll out open-loop payments prior to the FIFA World Cup, which Los Angeles will host in 2026. LA Metro has plans to work with Cubic through a no-bid contract. |

While this research found only a limited number of small to mid-size agencies implementing open-loop payment technology, the 2024 Pike et al. study “Open to Open-Loop: Payments Challenges for Public Transit” found that there is interest among small and mid-sized transit agencies, and also interest in technical assistance programs to address technology, staffing, and financial barriers. Table 2 provides examples of small and medium-sized agencies in the US that have implemented or plan to implement open-loop payment systems as well as details on system rollouts and annual ridership.

Table 2: Small and Medium Transit Agency Examples

| Agency | Launch Date | 2022 NTD Unlinked Passenger Trips | Summary |

| Santa Barbara Metropolitan Transit District (SBMTD) | 2021 | 4 million | SBMTD uses Cal-ITP Benefits for rider verification discounts. SBMTD operates 21 fixed bus routes and riders can pay using cash or open-loop. For more information on Cal-ITP, see the section on statewide efforts below. |

| Monterey-Salinas Transit (MST) | 2021 | 1.9 million | MST uses Cal-ITP Benefits for discount eligibility verification. MST operates roughly 30 fixed bus routes. Customers can pay using cash, GoPasses, GoCards, and open payment methods. For more information on Cal-ITP and the Mobility Marketplace, see the section on statewide efforts below. |

| Coast RTA | September 2022 | 603,000 | In September 2022, Coast RTA reinstituted fares and an open-loop contactless payment system after going fare-free during the COVID-19 pandemic. Accompanying this initiative, Coast RTA implemented a Tap to Cap pilot program to accommodate fare capping. |

| Connecticut Transit, Meriden Division (CT Meriden) | October 2024 | Unavailable | CT Meriden is one of two Connecticut transit agencies participating in the first phase of the Connecticut Integrated Transit Mobility Project (CT-ITMP), a USDOT SMART grant funded pilot program to establish an interconnected, multimodal statewide public transit system using open-loop payment technology. Five CT Meriden routes are included in the pilot. |

| River Valley Transit (RVT) | October 2024 | 41,700 | RVT is one of two Connecticut transit agencies participating in the first phase of the Connecticut Integrated Transit Mobility Project (CT-ITMP), a USDOT SMART grant-funded pilot program to establish an interconnected, multimodal statewide public transit system using open-loop payment technology. |

| Sacramento Regional Transit (SacRT) | 2025 | 11.3 million | Multiple mobility providers in the Sacramento area, including SacRT, are rolling out Tap2Ride contactless payments. |

A handful of rural transit agencies are implementing open-loop payment technology. For example, the Far North Transit Group, a consortium of four transit agencies in Northern California, implemented open-loop payment technology for fixed-route and dial-a-ride transit services. The agencies worked through Cal-ITP’s Mobility Marketplace to procure the payment technology. Riders can transfer between routes on a particular system for free provided they use the same open-loop enabled debit or credit card they used for the first leg of the journey within two hours of a trip. The agencies launched contactless open-loop payment in 2022. Table 3 presents details of Far North Transit Group agencies, including information on open-loop payment system rollouts and annual ridership.

Table 3: Rural Transit Agency Examples

| Agency | Launch Date | 2022 NTD Unlinked Passenger Trips | Summary |

| Humboldt Transit Authority

(Far North Transit Group Consortium – California) |

2022 | 237,000 | Operating a fleet of 53 buses, serving 600,000 riders a year. All areas within Humboldt County are considered “rural” and qualify for/use Section 5311 funds. |

| Lake Transit Authority (LTA)

(Far North Transit Group Consortium – California) |

2022 | 149,100 | While the population of Lake County as a whole exceeds 50,000, no individual community within the region meets the definition of “urbanized area,” qualifying the region-wide Lake Transit Authority for Section 5311 funds. |

| Mendocino Transit Authority

(Far North Transit Group Consortium – California) |

2022 | 102,000 | Mendocino Transit Authority has eight fixed bus routes and provides connections to a number of transit services, including Greyhound, Amtrak, and neighboring services. Mendocino Transit Authority is a recipient of Section 5311 funds. |

| Redwood Coast Transit Authority (RCT)

(Far North Transit Group Consortium – California) |

2022 | 47,100 | In June 2024, RCT adopted a resolution to authorize Federal Transit Administration (FTA) Section 5311 funding for operating expenses. |

Statewide efforts supporting open-loop contactless payments

State Departments of Transportation (DOTs) and other state agencies are uniquely positioned to create efficiencies and coordinate across transit agencies and jurisdictional boundaries, particularly in small urban or rural communities. State DOTs are well-positioned to apply for federal grants to support this work.

The California Department of Transportation (CalTrans) has taken the strongest state-level approach to supporting open-loop payment technology through the California Integrated Travel Project (Cal-ITP). Cal-ITP has been promoting the necessary technologies to support the adoption of open-loop payments through its Mobility Marketplace. The Mobility Marketplace features California State Purchasing Schedules with multiple vendors in each category that transit agencies, including those outside of California, can contract with to implement the technology, including fare collection hardware/software and data plans. Information about the program including the state purchasing schedules or Master Service Agreements in California are available on its website. While the Mobility Marketplace is available to transit agencies of any size, it is geared to medium and smaller transit agencies because of the product gaps in the market, and the relatively smaller buying power of these agencies. For a variety of reasons, smaller agencies often cannot procure technology as a stand-alone agency. A key reason it is more difficult for mid-sized and smaller agencies is that every large system is custom and generally proprietary, so none of those systems are interoperable with each other, intended to be copied, or intended to scale up or down. This is true for many transit technologies, not just payment technology. The Mobility Marketplace resources (including negotiated rate Master Service Agreements) lower the entry costs for implementing transit technology and provide smaller agencies access to economies of scale.

Credit: California Integrated Travel Project (Cal-ITP)

In January 2025, FTA released guidance on third-party contracting which governs how grant recipients can award and administer contracts to subcontractors and vendors. The circular clarifies that using state purchasing schedules like the ones available through the Mobility Marketplace is no longer allowed for FTA grant recipients. However, these agreements can still be supported by state efforts, and can serve as a useful reference tool for agencies to understand some of the cost considerations for implementing open-loop payment systems.

Connecticut Department of Transportation (CTDOT) offers an example of a State DOT that is using the Mobility Marketplace to support the development of open-loop contactless payments statewide. With support from a USDOT Strengthening Mobility and Revolutionizing Transportation (SMART) grant, CTDOT is launching the Connecticut Integrated Transit Mobility Project (CT-ITMP), which will enable open-loop payments on two systems (CT Transit Meriden division and River Valley Transit in Middletown). These two systems serve multiple municipalities in the state and riders often transfer between them. CT-ITMP aims to facilitate seamless transfers for riders, eliminating the need to purchase multiple passes in advance of boarding. CTDOT used the Mobility Marketplace to procure technologies. The first phase of the pilot launched in October 2024. This initial stage aims to test the proof of concept of integrating fare policies across two service providers. Connecticut is a small state geographically, but very dense, and with fragmented transit services. As the project evolves, CTDOT envisions a fully statewide, connected system where riders can use the payment methods they already have to get around and transfer between transit services.

Below are other statewide efforts that support similar payments initiatives. These programs do not specifically support open-loop payment systems but show the impact of state-level programs when implementing technology-driven payment solutions and developing interagency partnerships.

- NEORide: is an Ohio-based, multi-state council of governments that has been supporting, among other initiatives, multi-modal trip coordination and payment technology integration. The consortium serves as a model for other states interested in pursuing technology innovations in public transit as it demonstrates the importance of—and strength behind—interagency partnerships. NEORide has contracted with Masabi, a booking and payment platform company, to develop a single account-based fare payment system called EZfare. EZfare is a closed-loop system that allows riders to use the same payment methods for 15 different transit agencies across three states. Passengers can purchase fares for any of the participating transit systems using the EZfare app, and board buses either by showing the purchased ticket to the bus driver or by using their phone to scan a barcode on a fare validator, equipped on some buses. NEORide received a $3.3 million grant from the Ohio Department of Transportation to support the installation of these validators. Partnerships with retail vendors allow unbanked or underbanked customers to pre-load their accounts with cash.

- Minnesota Department of Transportation (MnDOT): MnDOT received funding through the FTA’s Accelerating Innovative Mobility (AIM) program to develop a regional Mobility as a Service (MaaS) platform. Focused on rural counties and small urban communities, MnDOT worked with smaller agencies to develop General Transit Feed Specification (GTFS) and GTFS-Flex data feeds, as well as piloting demand responsive transportation (DRT) transactional data specifications. Payments for the MaaS platform are handled through Transit App. While this is a proprietary platform, the MnDOT application is designed to digest open-source data feeds.

There are also opportunities to work with agencies in the early stages of updating payment technology systems to discuss the potential applications of open-loop payments. The Illinois Department of Transportation (IDOT) provides funding to design and implement an integrated technology system for trip scheduling and fare collection that will facilitate non-emergency medical transportation trips and interagency passenger transfers. Though it is unclear at this early stage whether this project will incorporate open-loop payments, it shows opportunities for state DOTs to pursue regional transit payment coordination and fare integration in a way that can open the door to open-loop systems down the line.

Potential Benefits

Following is a review of the most commonly associated benefits of open-loop payment systems. For transit agencies in particular, the potential increase in ridership and reduced operational costs of transitioning to open-loop payment systems can offer a positive return on their investment.

Improved Rider Experience and Increased Ridership

Open-loop payment benefits extend to both riders and transit agencies. For riders, open-loop payment systems can be more convenient and flexible than closed-loop systems. A rider can access transit without having to create an account, use a secondary transit agency-specific payment card, stand at a ticket vending machine, or carry cash. This is particularly relevant to occasional riders or tourists. If someone travels or transfers between multiple different open-loop transit systems, they already have a universal payment system that will work without having to create separate accounts. This convenience and interoperability across transit systems and mobility operators can support a more accessible and connected transit system, supporting increased ridership from current transit users and attracting new riders to a more seamless public transportation system. Financial institutions may also want to promote card use and contribute to increased ridership through their own promotion of open-loop payments.

When SEPTA initiated open-loop payments in 2023, the agency anticipated an improvement to customer experience through improved transit service; contactless payments can increase the speed at which customers can board vehicles, particularly during peak commute hours, reducing wait times overall.

Reduced Infrastructure Costs

Open-loop payment systems can also save transit agencies money through reduced transaction and infrastructure costs, including reducing or eliminating the need for ticket machines, card issuance, lower transaction costs, reduced staffing behind ticket counters, and less handling of cash. When TfL introduced open-loop payments, the agency was able to move ticket counter staff from behind counters to the fare gates where they were able to provide more direct technical assistance to customers.

As WMATA began transitioning to open-loop payments in 2021, the agency estimated over $3.6 million in savings between fiscal years 2021 and 2029 from reducing fare collection and card provisioning costs. This amount includes the additional cost of an incentive program to encourage adoption of the payment system. WMATA plans to fully roll out open loop payments in May 2025.

Interagency Coordination

By allowing for universal payment methods, riders can seamlessly transfer between multiple transit services. In addition to improving transit accessibility and ridership, open-loop payment systems can support other interagency coordination efforts. In the Far North Transit Group example mentioned previously, all four transit agencies involved in the project were able to implement a region-wide fare-capping system so that riders could benefit from fare capping even when using multiple transit services.

Fare Capping

Requiring cash for fare payment can create complications for both riders and agencies. Per Carl Sedoryk, general manager and CEO of Monterey-Salinas Transit, “We recognized for a long time that collecting cash is the most expensive and inconvenient way for our passengers to purchase our service. And it’s also the most expensive and inconvenient way for a transit operator to collect payments.” Although cash-based systems can act as a backstop for some of the least-resourced passengers who might lack access to bank cards and app-based mobile technology, they also complicate the application of discounts and fare capping for users who qualify.

Fare capping enables frequent riders—who often have the lowest ability to pay for a transit pass upfront—to take advantage of the bulk discount of a daily, weekly, or monthly pass without the upfront costs. The technology can automatically calculate the maximum cost based on the number of times and days a rider uses the system, effectively translating to a fare cap as riders reach maximum costs within a given period. Several transit agencies have cited fare capping as an advantage of open-loop contactless payments, including DART, MDT, MTA, and TriMet. Fare capping is not unique to open-loop payment systems, as closed-loop payment systems can also accommodate this approach. However, by lowering barriers to accessing these policies and allowing for several payment options, open-loop technologies can support access to these benefits to a wider riding population.

Potential Challenges/Risks

A number of challenges and risks can accompany open-loop payment systems, including several associated with handling credit or bank cards in any context.

Transaction Fees

Transit agencies should be aware of the interchange fees charged on each transaction. These fees do not include other operational costs, such as network assessment fees or payment service provider fees. Although Congress regulates debit card interchange fees per the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, credit card interchange fees are not regulated in the same way. While interchange is set by and collected on behalf of issuing banks, the rates are published and implemented by each payment network. Further, while rates are published, certain industries or industry players are understood to have obtained favorable agreements for lower rates. The exact costs of transaction fees vary due to a variety of factors. To offer an example, the Far North Transit Group, consisting of four rural transit agencies in California, has reported an average of 25 cents per transaction, just under 7% of total fare revenue. Especially for small agencies, understanding these new costs may pose a barrier to comfort with open-loop payment, and the costs of adoption may be higher for those who do not have the financial resources, sales volume, or bargaining influence to negotiate a lower rate. As part of the Cal-ITP open-loop payment technology program, Visa reportedly lowered its transaction fees in conjunction with the contactless payment technology rollout plan.

In London, credit and debit card fee regulation started in 2009 and TfL benefited from those negotiations as transaction fees are capped as low as .3% for credit cards and .2% for debit cards. This capping has helped TfL reduce its operational costs and make contactless payments more financially sustainable. The increased ridership that contactless payments are believed to support offers additional financial stability.

Taking cues from TfL, other European cities with open-loop transit payments, and the Cal-ITP Mobility Marketplace, there are opportunities for federal leadership to cap or negotiate lower credit card transaction fees on behalf of transit agencies and make fees more transparent in the US. These efforts could support further transit open-loop payment integrations.

Balancing Fraud Risk with Transaction Speed and Other Transit-Specific Considerations

Open-loop payments use the EMV standard (developed by EMVCo, an association founded by Europay, MasterCard, and Visa), a global technical and security standard for chips on bank cards. When someone uses an EMV-enabled device for payment, the transaction is authenticated, verified, and authorized at the terminal; the system ensures that the payer has enough funds in their account to cover the transaction. However, as mentioned previously, public transportation systems using contactless open-loop payments use the cEMV standard, which is built on the EMV standard but can accommodate contactless transactions. To support faster boarding times, these payments are not always authorized immediately. This could allow users to access the transit system without having sufficient funds to pay the fare. However, these risks can be mitigated partly through other solutions, such as the Payment Account Reference (PAR), a non-financial reference allowing merchants to track payments across payment accounts and help identify fraud more quickly while minimizing potential risk exposure. Other data standards also play a role and are discussed in UITP’s 2022 white paper Open-Loop Payment in Public Transport.

Technology Considerations

The technology that underpins open-loop payments is another potential barrier, particularly for smaller agencies that may not possess the technical capacity to manage large-scale technology and data projects.

Credit: Turner et al.

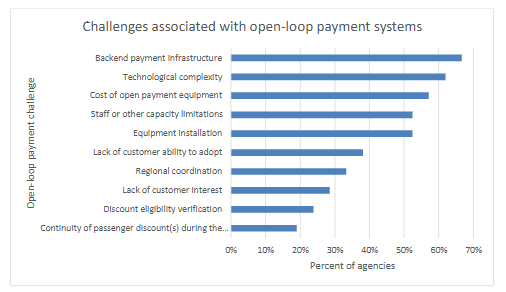

A 2023 study by Turner et al. demonstrates the importance of addressing technology barriers. The following graph shows the results of a survey on what agencies report as challenges associated with open-loop payment systems. “Backend payment infrastructure” was the most frequently cited challenge, followed by “technological complexity.”

FTA could support these technical capacity considerations by providing resources and offering technical assistance to transit agencies. This also helps to build the case for smaller agencies to look to state DOTs for technical assistance and to adopt solutions like the Mobility Marketplace that have negotiated Master Service Agreements that, if not used, offer a starting point for transit agencies to understand the considerations related to open-loop technology and its costs.

Approaches to Managing Discount Programs

Transit agencies offer discounted fares for seniors, Medicare recipients, people with disabilities, students, and other groups of riders. Per the Federal Transit Act (Section 5307(d)(1)(D)), these discounts are required for agencies using federal funds. In closed-loop systems, discount eligibility information is part of a user profile associated with a specific rider. However, since an open-loop payment system allows travelers to tap their own bank card, credit card, or bank card-enabled smartphone or smartwatch, it does not necessarily associate the card with a specific person and eligible benefits. Some open-loop systems are able to apply discounts by matching eligibility to a bank card. This requires the eligible rider to register the bank card with the transit agency. MTA’s OMNY, for instance, began supporting fare discounts for bank cards in 2022, with eligible riders able to register via the OMNY website. Previously, riders had to use a Metrocard to get access to discounts.

In California, Cal-ITP developed a web application that uses Login.gov, the US General Services Administration’s (GSA’s) single sign-in service for government agencies, to verify a customer’s eligibility for various fare benefits and link those benefits to an open-loop payment card. When a user is directed to the Login.gov web app from a transit agency’s website, they can verify their identity and the system will link their discount eligibility with their bank card in the transit agency’s system. Monterey-Salinas Transit and Santa Barbara Metropolitan Transit District are among the agencies that have integrated Login.gov into their discount programs. While this project still presents barriers, it shows one solution for verifying eligibility in an open-loop payment system. To further support Login.gov and other rider discount eligibility approaches, FTA could further collaborate with GSA to support these solutions at a national level.

Another important consideration is how to bring the benefits to unbanked or underbanked riders. Many transit agencies are working to connect these riders to reliable, low-fee financial services, allowing them to take advantage of open-loop payments and more readily access discounts and fare capping. Bank On, a platform launched under the Cities for Financial Empowerment Fund, certifies banks and credit unions to help identify non-predatory financial institutions with low fees and requirements. As Bank On relates to transit access, agencies could use and promote the initiative in their own open-loop marketing materials. This initiative does not address all concerns over access to bank cards, but it is an attempt to improve access to information and mitigate some of the barriers facing unbanked and underbanked people. By helping connect riders to reliable, safe, and affordable banking options in addition to accepting cash (which most transit agencies still do), agencies could use open-loop transit payment initiatives as a catalyst for promoting financial opportunity.

Conclusion

Open-loop contactless payments are increasingly common in the US, and as consumers become more accustomed to tapping to pay for everyday purchases, it is easy to imagine how that convenience could carry over to public transit. Among other benefits, open-loop systems can offer easier use for customers, reduce operational costs for agencies, improve coordination across services, and support the modernization of fare policies and systems.

Open-loop payments for transit helps to bridge that gap and supports a more efficient and user-friendly interoperable public transit system. While there are currently challenges that agencies must overcome, such as credit card transaction fees, complexity in supporting rider-eligible discounts, and the need for growing technical capacity. These, and other challenges discussed in this summary, also have a solution, or set of solutions, that agencies at various levels of government can adopt to address the issues. These all take time and add to the implementation complexity, particularly for early adopters, but the benefits of open-loop payments are far-reaching. There are also key roles for the federal government, states, and the collective influence of transit agencies to support the scalability of open-loop payments while learning from these early adopter experiences.

Acknowledgments

A special thank you to the following people who shared their time and expertise reviewing this summary and supporting this work.

- Gillian Gillett, Chief Data and Digital Services Division Program Manager, California Integrated Mobility, California Department of Transportation

- Colin Murphy, Research Director, Shared-Use Mobility Center

Originally published April 2, 2025.