Types of Electric Vehicles

There are a variety of EV types on the market. Battery Electric Vehicles (BEVs) use electric motors which run solely with battery power, and thus have zero tailpipe emissions. These vehicles do not have internal combustion engines (ICEs) and are fully charged by external power sources connecting to the power grid, such as a wall socket or charging station (see the “EV Charging Types” section in this Learning Module for more information on types of charging stations). Because BEVs do not have ICEs, they can have large batteries capable of long ranges, currently as high as 500 miles. As electricity generation shifts to more sustainable and cleaner sources, BEVs become more and more environmentally friendly.

Fuel Cell Electric Vehicles (FCEVs) are also fully electric vehicles, but they produce the electricity using a fuel cell powered by hydrogen. Rather than plugging the vehicle into an electricity supply to recharge the battery, a FCEV uses a supply of hydrogen which mixes with oxygen from the air to produce electricity. The hydrogen needs to be refilled like with gas-powered vehicles, but the only waste product from this reaction is water vapor.

Additionally, there are several types of Hybrid Electric Vehicles (HEVs), which operate primarily on gasoline, but use electricity to improve fuel efficiency and vehicle performance. Generally, HEVs have both an ICE as well as an electric motor. The ICE burns gasoline for energy, while the electric motor gets its power from energy stored in the battery. In most HEVs, the battery gets energy through regenerative braking; when the driver brakes, the electric motor operates as a generator and converts the vehicle’s kinetic energy into electrical energy, which is then stored in the battery. This energy is then applied to the vehicle in various ways with varying efficiency. The energy from regenerative braking can be used at the same time as the ICE to boost vehicle performance, or to power the vehicle at low speeds for very short distances. There are also Fuel Cell HEVs, which work much like traditional HEVs, but are primarily hydrogen-powered rather than gas-powered.

Plug-in Hybrid Electric Vehicles (PHEVs) also have both an ICE and electric motor, but have larger battery packs than traditional HEVs and can be charged externally through a charging station or outlet. PHEVs can operate for longer distances than traditional HEVs using the electric motor – up to about 25 miles – though still not as long as fully electric vehicles.

Next Subsection

EV Terminology

Just like engines that run on gas, PEVs have their own set of technical terminology. Electric Vehicle Supply Equipment (EVSE) is the industry term for charging stations and charging appliances. When discussing EVSE, it is important to talk about how electricity works and where it comes from. The US Department of Energy maintains a helpful guide. A common analogy in electrical engineering relates batteries to a wheel powered by water from a hose.

- Amperage, measured in Amps (A), is the amount of water flowing through the hose at any given moment. The higher the amperage, the more electricity can be used at any given point. This is determined by the wiring in a circuit breaker; most residences are equipped to handle between 100 and 200 amps.

- Voltage, measured in Volts (V), is the water pressure forcing the movement. The higher the voltage, the more amps it can process. This is determined by the wall outlet, which is generally equipped to handle 12V, or 240V.

- Wattage, measured in Watts (W), is the force generated by the wheel. It is the amount of power delivered, determined by multiplying amps by volts, and is determined by the device being charged. For a large device, like an PEV, the more common unit is a kilowatt (kW), or 1,000W.

In the US, 78% of power production comes from the private sector, about evenly split between several hundred large, investor-owned utilities (IOUs) and several thousand small independent producers. The other 22% comes from the public sector, with 7% coming from nine federal facilities and about 15% from mid-sized, publicly-owned utilities (POUs) run at the municipal or regional level. Transmission grids (often just ‘the grid’) refer to the high-voltage transformers and power lines that deliver electricity across regions to low-voltage, local distribution networks connected to outlets or transformers.

Previous Subsection Next Subsection

EV Charging Types

Electronic devices draw Alternating Current (AC) power, which is then converted to Direct Current (DC) power, the kind stored by batteries. As clearly defined by the EVSE provider EVgo, AC Level 1 charging requires only a plug and a conventional 120V outlet and can deliver 1.9 kilowatts (kW), or about four miles of range per hour of charging. This is what would be most appropriate for small batteries, like those used on bikes or scooters. AC Level 2 charging requires a 240V power source, like those used for heavy appliances, and can deliver up to 19.2 kW from a specialized charging station, offering up to 20 miles per hour spent charging. AC Level 3 charging, which is still under development, would allow for up to 43 kW. All AC charging uses a standard plug, SAE J-1772, to draw power.

Credit: ChargePoint. EV Charging Plugin Types

With DC Fast Charging, the AC to DC conversion happens in the station instead of the vehicle. These specialized stations can draw up to 480 volts that can be fed directly and quickly to the battery on board the vehicle. Due to the smaller size of batteries in many PHEVs, not all PEVs can use DC Fast Charging equipment. While a DC Fast Charger can deliver between 50 and 350 kW, or 90 range miles in 30 minutes, only certain brands of BEVs are capable of taking advantage of this higher-output charging, with 350 kW being the maximum for heavy-duty vehicles (HDVs) like buses and 150 kW for LDVs. [i] DC Fast Charging uses a variety of plugs depending on the vehicle manufacturer. The Combined Charging System, sometimes called “combo chargers” are used for American and European BEVs, while CHAdeMO is used for Japanese brands and Tesla Superchargers for its own network.[ii] Since 2013, Tesla has offered drivers an adapter that can convert CHAdeMO fast charging or AC J1772 connectors to its vehicles.

Previous Subsection Next Subsection

EVSE Accessibility

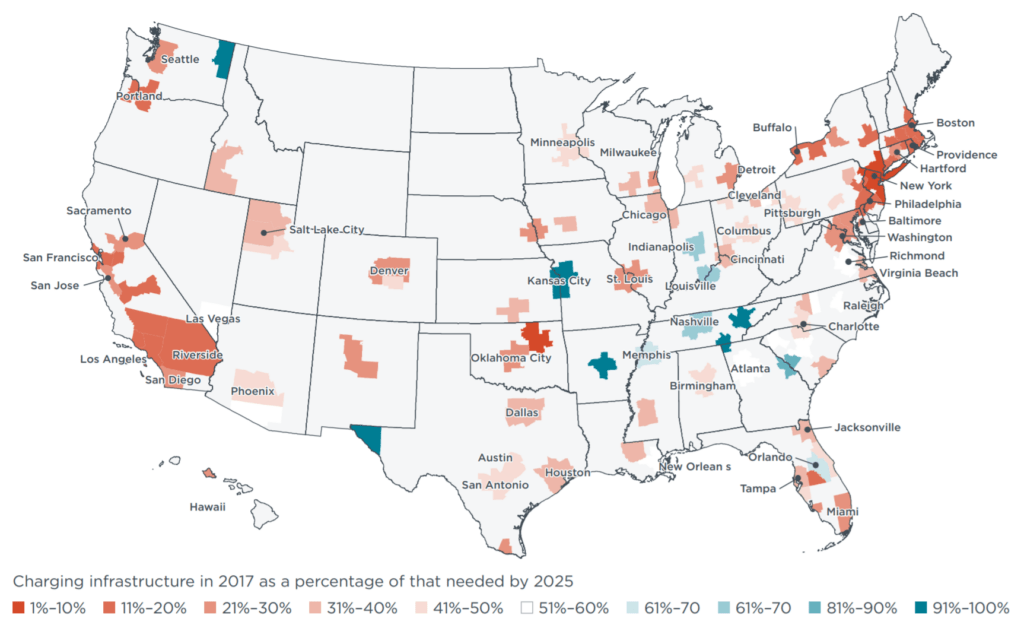

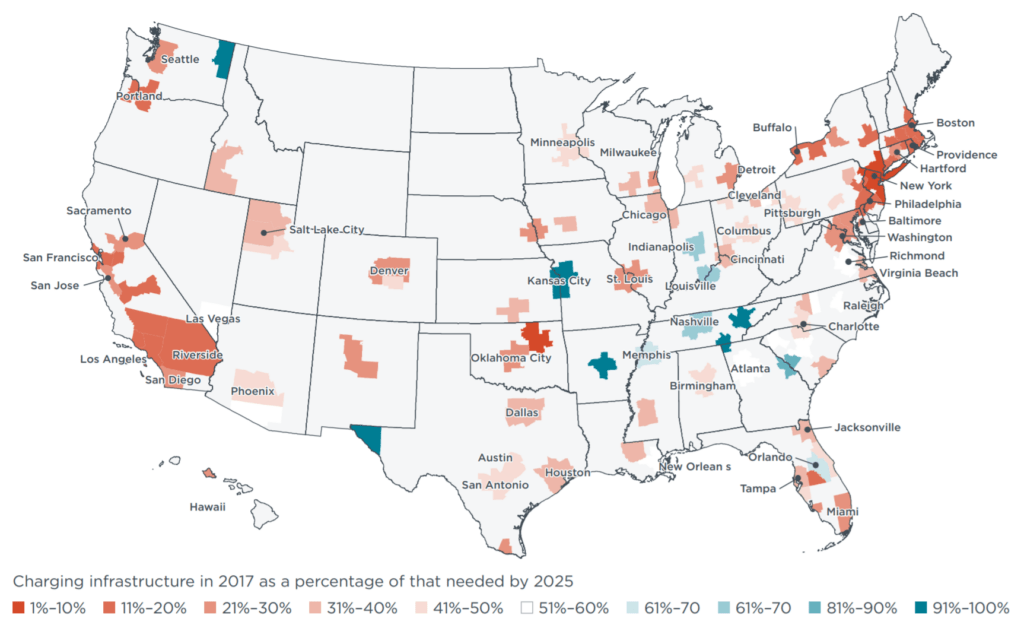

Whatever the type, there is a strong need for publicly accessible EVSE. The ICCT estimates that among the 100 largest metropolitan areas, all but 12 are predicted to face charging shortages unless AC Level 2 charging at workplaces increases by 7 times and destination charging by 3 times. [iii] Due to the slower charging rate, the relationship between the number of PEVs on the road and Level 2 ports is much more closely tied and many more Level 2 stations are needed than Fast Chargers. However, cities must still establish a baseline density of Fast Chargers. The National Renewable Energy Laboratory suggests one public Level 2 for approximately every 29 PHEVs and one Fast Charging point for every 588 BEVs.

Charging Infrastructure in 2017 as a percentage of that needed by 2025.

Shared modes that best complement Level 2 charging are those with several hours of inactivity at a time, such as ridepools or carsharing, that can be located at park-and-rides, workplaces, residential developments, or on-street parking with low turnover. For shared mobility services with high turnover, such as rides-on demand and certain carsharing models, Fast Charging helps minimize lost revenue spent charging. [vi] Pilot programs like Maven Gig and Lyft Express, which allow drivers to rent PEVs by the week from dealers and receive complimentary charging, show that Fast Charging is likely critical to wider adoption among drivers. [vi]

For transit using MDVs and HDVs, on-route charging can supplement overnight charging at storage depots and minimize service disruptions during the day. Because of the high cost of installation relative to the unit itself, it can be more cost-effective to cluster different forms of Fast Charging together even when supplying different modes. [vii]

Because of the applicability across EV modes and the relatively low cost of installation and operation, AC charging can be built out in greater volumes and is appealing to a wider group of stakeholders. When left to the market, Fast Charging deployment has largely been led by OEMs to support vehicle sales. The largest deployments of Fast Charging have come as a result of public spending programs or as restitution, the most notable being a 2016 settlement with Volkswagen that directs $2 billion dollars of investment in EVSE installation and another $2.7 billion in PEV grant funding to states.[viii] Attaining a baseline coverage away from highly utilized traffic corridors or commercial destinations will likely require similar public support.

Because of the applicability across EV modes and the relatively low cost of installation and operation, AC charging can be built out in greater volumes and is appealing to a wider group of stakeholders. When left to the market, Fast Charging deployment has largely been led by OEMs to support vehicle sales. The largest deployments of Fast Charging have come as a result of public spending programs or as restitution, the most notable being a 2016 settlement with Volkswagen that directs $2 billion dollars of investment in EVSE installation and another $2.7 billion in PEV grant funding to states.[viii] Attaining a baseline coverage away from highly utilized traffic corridors or commercial destinations will likely require similar public support.

Previous Subsection