General Market Trends

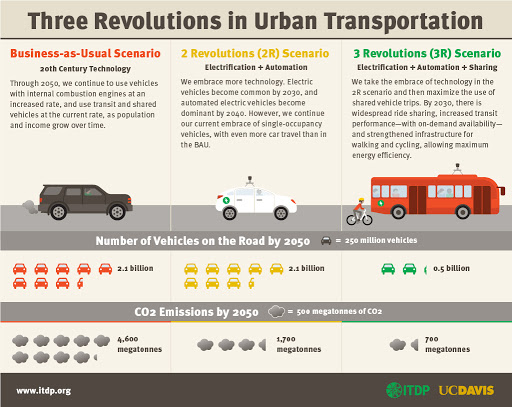

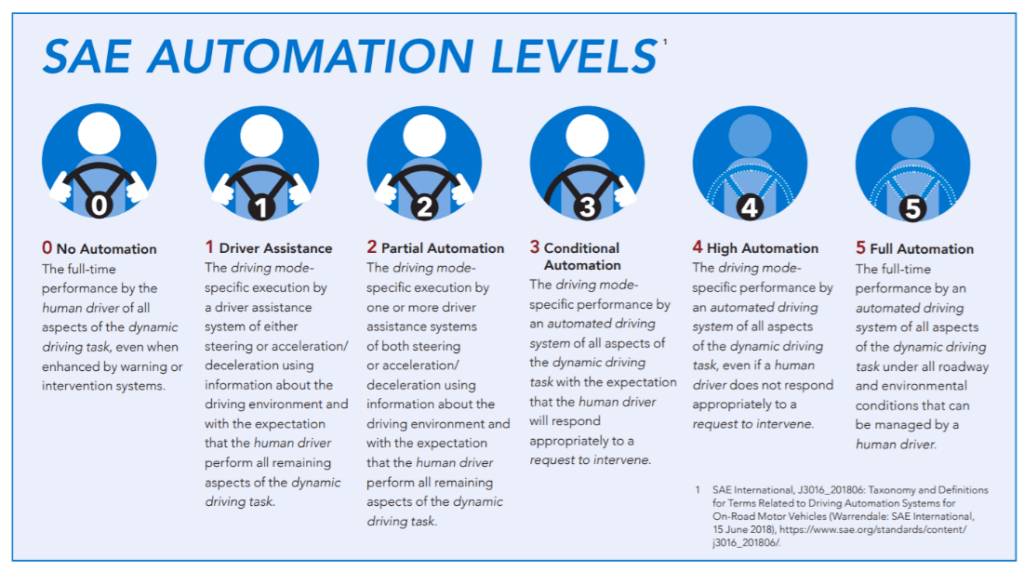

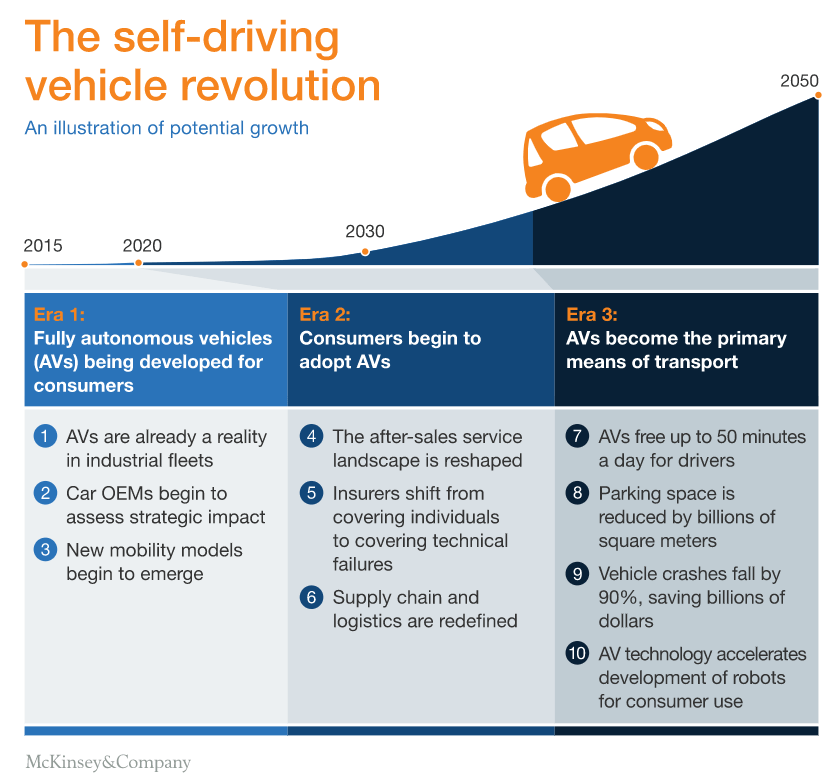

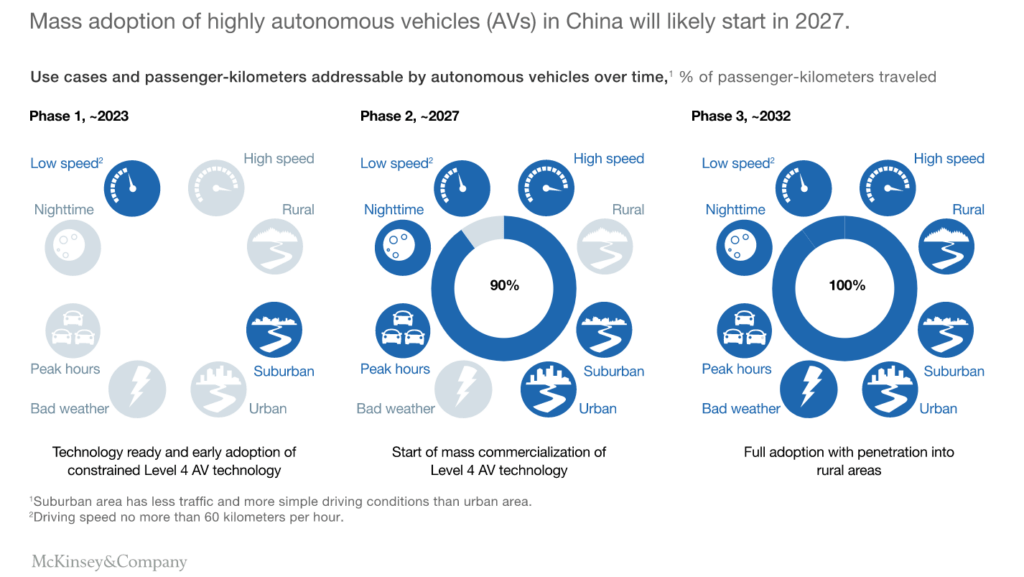

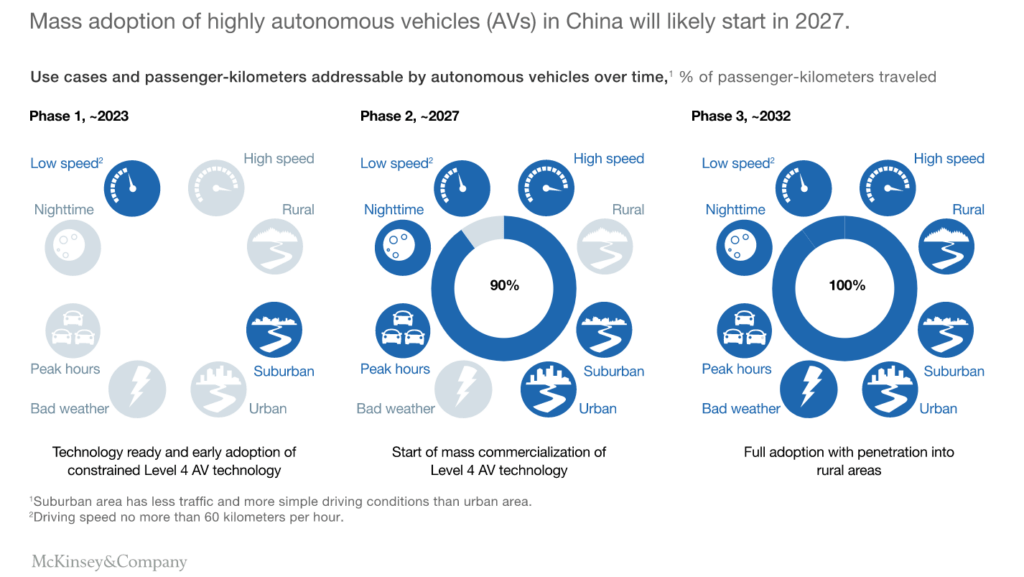

Although countries and cities are currently at different stages of AV deployment and development, there are some trends shared globally. As recently as 2016, many companies and individuals excited about the sector anticipated the operation of fully autonomous, driverless cars on public roads in just a few years’ time. However, the anticipated timeline has been extended, as developers and programmers tackle the significant hurdles related to large-scale AV deployment. In fact, in 2019, the CEO of Ford asserted that “[w]e overestimated the arrival of autonomous vehicles.” The cost of developing and testing sensors is decreasing, which may help accelerate this timeline, but the arrival of AVs operating widely on public roads remains unclear. A 2019 McKinsey assessment anticipates the mass deployment of Level 4 and 5 AVs in China in about a decade, while a 2022 report by the Victoria Transport Policy Institute anticipates Level 5 vehicles may be commercially and legally available globally by the late 2020s, but that the benefits of AV technology will only be realized when AVs are mainstream, likely in the 2050s or 2060s. Because transportation is more highly regulated than some other industries, the testing and legislation necessary to deploy them broadly may slow the market penetration.

Source: McKinsey & Company; diagram mapping estimated timeline of AV deployment in China. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/how-china-will-help-fuel-the-revolution-in-autonomous-vehicles

Generally, most experts anticipate that some of the earliest major deployments of autonomous technology on roads will involve intercity trucks that are able to be linked together along designated corridors. Testing of such projects is occurring, for example, with the EU-funded ENSEMBLE Consortium in 2021 and a US-based Truck Platooning Early Deployment Assessment planned for by the end of 2023.

Furthermore, according to a 2019 report released by the Society of Actuaries, entirely autonomous technology that involves no driver will likely be limited to ODDs such as weather conditions, geofenced areas, and designated times of day for several years to come as the necessary technology and infrastructure improve. Due to these ODDs constraining their operation, AVs are anticipated to be deployed primarily in fleets rather than as a private means of transportation. The report even suggests that some states may prohibit private ownership of AVs altogether.

Next Subsection

Select Private Sector Leaders

An estimate released by GM’s AV unit, Cruise, in early 2020 values the entire global AV industry at $8 trillion. A similar analysis from Intel in 2017 placed the estimated value at $7 trillion. As a result, it is perhaps not surprising that companies are eager to gain a competitive advantage regarding AV technology, testing and deployment. The following list is by no means exhaustive, but it includes some of the major private-sector players pushing the needle on AV deployment.

- Amazon: Delivery robot Scout currently operating in Washington & California.

- Aptiv: Testing in Boston, Las Vegas, Pittsburgh, Singapore, among others.

- Baidu: Testing self-driving taxis in China.

- Continental: Primarily delivery robots, testing in Germany.

- Cruise (General Motors): Testing in Las Vegas; Voluntary Safety Self-Assessment submitted to NHTSA 2019 available here. Considered one of leaders in AV development for cars.

- EasyMile: Major driverless technology vendor, testing globally.

- Ericsson: Operating 2 AV shuttle buses in Stockholm, Sweden.

- Ford: Testing in Miami, DC and Austin; Voluntary Safety Self-Assessment submitted to NHTSA 2019 available here.

- Huawei & Audi: Audi’s A8 was the first hands-free driving enabled vehicle released; working with Huawei on developing technology for Audis sold in China.

- May Mobility: Operating in Ann Arbor, MI, Grand Rapids, MI, Arlington, TX, and Fishers, IN.

- Mercedes-Benz, Daimler & BMW: Testing in Germany, US and China; developing Level 4 technology.

- Nuro: First company to receive autonomous vehicle exemption from NHTSA from three federal motor vehicle standards; testing grocery delivery vehicles in Houston, TX.

- Nvidia: ADS used by several companies around the globe. Voluntary Safety Self-Assessment submitted to NHTSA 2019 available here.

- Tesla: Developing and testing models.

- Volkswagen: Developed its own subsidiary, Volkswagen Autonomy (VWAT); investing in Argo AI, AV software start-up company; also working with IBM.

- Volvo: Testing Level 2+ vehicles near Stockholm; collaborating with Uber, Baidu, and Nanyang Technological University and Singapore’s Land Transport Authority to launch autonomous bus; also heavily involved in truck platooning testing.

- Uber: Testing Volvo XC90; had been testing in Arizona, California, Texas; now limited to San Francisco area. Voluntary Safety Self-Assessment submitted to NHTSA 2018 available here.

- Waymo (Google): Tests in Los Angeles, CA, San Francisco, CA, and Phoenix, AZ; first to test fully autonomous, driverless vehicles in the US. Voluntary Safety Self-Assessment submitted to NHTSA 2019 available here. Considered one of leaders in AV development for cars.

As of December 2021, 28 companies had submitted their Voluntary Safety Self-Assessment to NHTSA, and all are publicly available here.

Previous Subsection Next Subsection

Planning for the Future

Safety & Liability: According to an annual report released by KPMG on AV readiness at the national level, there are several key components a country needs to have in place locally in order to be sufficiently prepared for AV proliferation. First, in regards to national infrastructure, some of the elements that will be most important to support shared AVs are sufficient numbers of EV charging stations, overall technological infrastructure, such as mobile internet and 4G or 5G coverage, and high-quality roads. Specific roadway infrastructure that many agencies are exploring include smart traffic signals and parking and curb management. Second, having national and local policies and legislation in place will also be critical to ensure safe deployment of AV fleets; KPMG suggests that AV regulations pertaining to safety, government-funded AV pilots, and data-sharing policies are most central. Many agencies are also establishing AV-focused departments or agencies to handle such regulation. See the following section, “Existing AV Regulations” for some national, state- and city-level AV policies. Lastly, to be fully prepared for the mass deployment of AVs, countries need to have a well-established marketplace that facilitates innovation. Markers of such a marketplace include AV firms headquartered in the country, patents filed locally, and a high EV market share.

Steps to Ease the Transition from Traditional Types of Service to AVs: There are four types of service for which shared AVs are anticipated to be adopted most readily.

- Freight & Deliveries: Urban freight is likely to be one of the first areas where AV technology will be deployed broadly. For example, AV technology company Nuro was the first company to receive autonomous vehicle exemption from NHTSA from three federal motor vehicle standards for its delivery vehicle, while truck platooning efforts are already underway across the globe. In order to support these efforts, states that have not already legalized truck platooning can ensure that their roads permit it, and they can stay abreast of the lessons learned from testing projects like the on-going EU-funded ENSEMBLE Consortium and the 2016 EU Truck Platooning Challenge. NACTO’s Blueprint for Autonomous Urbanism also encourages agencies to enable various carriers to consolidate facilities and incentivize smaller fleet vehicles. At the city level, city leaders will need to explore opportunities to better manage curb access, particularly as it relates to AV delivery vehicles. Examples of such management tools are included in the following section: “Steps to Ensure Adequate Safety and Infrastructure” under the subsection Curb Management.

- Fixed-route transit: In addition to freight and deliveries, fixed-route transit is another area where AV technology could prove beneficial – if leveraged proactively. In anticipation of the development of technology that can support high-frequency, fixed-route AV buses and trains, planners should pursue opportunities to prioritize transit use over other, less efficient modes of travel. One avenue to prioritize transit and encourage use of shared modes prior to the arrival of AVs is to explore establishing dedicated lanes and signal priority, in particular where density, congestion, and ridership are highest. In the short term, a commitment to prioritize these core transit routes may mean protecting them from competition from ridesourcing, especially where ridesourcing traffic adds congestion that could undermine transit service. Such policies can build use of and familiarity with fixed-route transit service, which can later facilitate greater use of transit.

- On-demand AV microtransit: Unlike core transit routes, lower-ridership routes are likely to be better served by autonomous on-demand microtransit. For these routes – and particularly at certain times of day – smaller vehicles serving more dynamic routes will likely be more effective than larger vehicles on fixed-routes; the smaller vehicles would take up less space and be less disruptive to other traffic, and they could be platooned when appropriate. In order to prepare, cities can look for opportunities to replace unproductive bus routes with microtransit, and they can deploy incentives (such as VMT tolling) to promote shared-ride microtransit instead of single-occupancy ridesourcing. Furthermore, many ongoing AV pilot programs in the US currently are microtransit programs operating on college and hospital campuses and military bases; lessons from such pilots regarding planning and regulation are likely to emerge in the coming years that can be applied to systems serving the general public.

- Ridesourcing: Cities are already wary of use of single-occupancy ridesourcing – with vehicles operated autonomously or not – replacing use of public transit. According to several reports, private vehicle ownership is anticipated to decline in the coming years, which may make ridesourcing an even more appealing form of travel. Additionally, MaaS platforms will likely blur the line between ridesourcing and microtransit, further complicating regulation efforts. However, ridesourcing leveraging AVs can be a cost-effective alternative to traditional paratransit and non-emergency medical transportation, expanding mobility for the physically impaired and the elderly in both urban and rural environments. City-level policies that could help prepare for the advancement of AVs in ridesharing include: subsidizing ridesharing trips that complement transit (by providing a first-/last-mile link or replacing bus service); taxing ridesharing trips that compete with transit; raising revenue through VMT tolling; and exploring opportunities to launch ridesharing programs for people with transportation challenges.

Steps to Ensure Adequate Safety and Infrastructure:

In addition to the approaches listed above that cities can pursue to better facilitate the use of AVs among traditional types of service, there are also several policies that pertain to road infrastructure and traveler safety that cities can pursue.

- Strategic routing: When planning for fixed-route transit and microtransit utilizing AVs, one of a city’s’ responsibilities will be to develop conditions that support the use of AVs without negatively affecting opportunities for pedestrians and active transportation. AVs will likely be programmed to stop whenever a pedestrian steps in front of them. Transit vehicles may not be able to stop abruptly for pedestrians without injuring on-board passengers. For example, an incident in Columbus, Ohio in early 2020, in which a passenger on an AV traveling at low speeds was hurt when vehicle made an emergency stop, led to the NHTSA ordering the fleet of vehicles to stop carrying passengers. While this is a current concern, technology continues to evolve. It is important to note that separating pedestrians and AVs completely would lead to a very different kind of street – one that differs starkly from the type of streets for which Complete Streets policies have been advocating.

- Smart signals & sensors: Traffic signal modernization should make it increasingly possible for cities to direct and manage the flow of traffic by redistributing green time strategically, including redirecting cars away from routes where space is needed for dedicated transit lanes and toward routes designed to keep AVs moving. The combination of dedicated lanes and signal priority at intersections could create a network of high-capacity transit lines that are virtually immune to congestion. To enable AVs in particular, cities are exploring signals with communication capabilities, smart lighting systems, camera-enabled equipment on vehicles and infrastructure, and smart crosswalk detectors. The Vancouver & Surrey Smart Cities Challenge Finalist Application, submitted in March 2019, is a useful resource to see examples of intelligent transportation system technologies planned to prepare for AVs and safer multimodal corridors.

- Advanced travel demand modeling and planning: In addition to dynamic signal controllers that can compensate for background traffic for each instance of transit signal priority, cities can also explore high-fidelity travel demand modeling that takes into account the changing dynamics of traveler needs, preferences and options. Furthermore, many cities are pursuing approaches aimed at optimizing the flow of people rather than vehicles; the Portland Bureau of Transportation’s Central City in Motion Plan is an example of such an approach. Barcelona’s effort to make superblocks is another example of prioritizing efficient multimodal transportation over traditional automobile travel. Within the citys’ planned superblocks, vehicle travel is restricted, facilitating more space for pedestrians and bicycles. Vehicular congestion and interaction with difficult-to-predict pedestrians are reduced on the surrounding streets – key for eventual AV deployment.

- Parking: Overall demand for parking is likely to decline sharply as privately owned vehicles are replaced by fleets of vehicles that serve many people, are in motion much more and are parked much less. However, because AVs have the capacity to continue to circle in traffic rather than pay for parking, there is the potential for AVs to actually increase congestion and VMT. Cities can address this changing demand for parking through pricing incentives, some of which include: the elimination of free on-street parking to drive down ownership of rarely used vehicles; the elimination of parking requirements for new developments until demand for the existing supply is effectively managed; and the implementation of congestion pricing to discourage AVs from circling in traffic. This could involve higher prices for empty vehicles, or time-based and distance- or energy-based charges. In addition, cities should be aware that parking structures specifically designed for AVs will likely require different layouts. For example, the University of Oregon’s Urbanism Next Center anticipates that the size of both parking spaces and aisles will adjust to the changing size and shape of AVs, garages will accommodate electrical charging needs, and compact loading lines could replace the traditional layout of singular rows and aisles to increase efficiency among shared AV storage.

- Micromobility: Micromobility (bikes, scooters, and whatever comes next) is expected to continue to expand. To accommodate these modes, some cities both in Europe and America have begun lowering speed limits on streets in built-up areas to 30 km/hr (19 mph). Studies indicate that doing so increases the flow of vehicles while reducing pollution and crashes. These lower speed limits can help AVs interact more safely with travelers using micromobility, especially in dedicated low-speed lanes. Cities can also facilitate decreased vehicle conflict by prioritizing micromobility over single-occupancy vehicles and parking, and placing fixed-route transit in the center lanes.

- Curb management: Due to increased rates of home deliveries, TNC rides, and shared bike and scooter parking, the demand for curb access is already rising. The advent of AVs will add to this competition, as AVs will need access to the curb in order to pick-up and drop-off passengers and deliveries safely. To address this trend, cities should explore ways to charge for curb access, and they can replace on-street parking altogether with loading zones in trip-generating areas like shopping streets, job centers, and tourist attractions. Two examples of city-level efforts to proactively address the changing demands placed on curb access include Los Angeles’ Code the Curb effort to build a database of information on parking regulations, signs, and curb paint throughout the city; and Washington DC’s program to improve management of the city’s more than 500 curbside loading zones, which resulted in a new, comprehensive plan in 2017. Other resources for curb management in the age of AVs include:

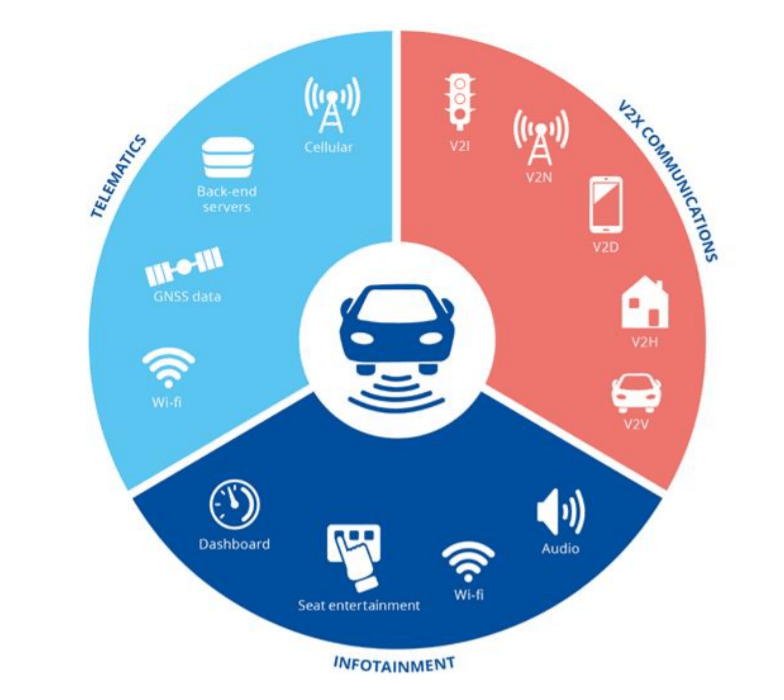

- Data & Cybersecurity: One of the greatest concerns regarding the advent of AVs is how to ensure that the resulting trip and passenger data is appropriately managed. One avenue that many cities are already pursuing is to develop a single trip-planning and booking app that integrates all modes of transportation. Such an app allows the public agency managing the platform to generate a greater range of ridership data, which can be combined with advanced travel demand modeling to optimize public spending on transportation infrastructure and operations. It also eliminates complicated or incompatible payments between systems, which makes it easier for people to choose public transit options.

In addition, cities need to assess what kind of data they need, and to explore how AVs will influence the availability of such data. NACTO’s Blueprint for Autonomous Urbanism 2.0 defines transportation data in two categories: first, journey data, which includes information on how people or goods move between points; and second, asset data, which includes information on infrastructure like curbs, parking spaces and bus stops. Going forward, GPS, vehicle-to-everything (V2X) technology, and growing digital databases will likely expand both journey and asset transportation data available to public agencies, making it possible for cities to see in real-time whether parking spaces are in use, the speed at which traffic is moving, and other valuable information. In addition to planning for ways to gather and securely store the increasing data available to them, cities should also take steps to ensure that their transportation staff is trained to assess this data to help plan for future investments.

NACTO and the Open Transport Partnership also launched the SharedStreets CurbLR data standard in 2018, which aims to provide an information-sharing platform that works for cities and companies to import previously incompatible data regarding traffic safety, traffic monitoring, and curb management, among others. Open source tools like this – as well as others, like Open Curbs – are crucial to helping public and private parties access and evaluate the growing amounts of data available to them. The Los Angeles Mobility Data Specification (MDS) is another data standard for mobility service providers developed by the Los Angeles Department of Transportation, and dozens of transportation agencies across the country have adopted it for their application programming interfaces (APIs). The Shared-Use Mobility Center also released a white paper in 2019 evaluating the lessons learned from the FTA’s Mobility-on-Demand Sandbox program regarding ways to determine the right data-sharing approach for a shared mobility project.

State- or federal-level regulation may also prove critical to ensuring cybersecurity following the deployment of AVs. For example, the European Union recently passed its General Data Protection Regulation, and one of its many components stipulates that personal traveler data will need to be separated from the data needed to guide vehicles; such a requirement will impact how cities and private companies alike will need to plan for data gathering and storage. The European Union Agency for Cybersecurity has also released a useful guide regarding cybersecurity of connected cars, including both automated and non-automated vehicles.

Many countries and cities around the globe are already taking these and other steps to plan appropriately for AVs. At the international level, Singapore’s Centre of Excellence for Testing and Research of Autonomous Vehicles is collaborating with The Netherlands’ Organisation for Applied Scientific Research to conduct research regarding how systems should operate and ways to establish an international standard for AVs. Similarly, the Netherlands, Germany and Belgium have established a program to accelerate truck platooning across their shared borders. Nearby, the Law Commissions of England and Wales and Scotland developed a shared, comprehensive legal framework for AVs throughout the United Kingdom in January 2022. See the following section, Existing AV Regulations, for some examples of specific policies already in place around the globe and in the US.

Previous Subsection Next Subsection

Policies and Regulations

International & National Policies and Programs:

- European Union (EU): In May 2018, the European Commission published its strategy for addressing automated mobility on roads. The communication outlines the EU’s vision for automated and connected mobility, ways to strengthen the EU’s existing technology and infrastructure to better support such mobility, opportunities to bolster the European market for AVs, and its next steps to regulate the sector. The Commission also published guidelines in 2019 for the EU approval process for AVs, including what manufacturers can anticipate from regulators and how national regulations can become more harmonious. In addition to developing AV standards and policies, the Commission is also co-funding related research and infrastructure. The European Parliament has also published this assessment, which details a shared EU approach to liability rules and insurance for connected and autonomous vehicles. The EU is also facilitating the designation and implementation of 5G cross-border corridors, which will permit automated cross-border travel between nations and will allow for the study of safety, connectivity and digital technologies.

- The Netherlands: According to KPMG’s annual ranking of AV readiness in 2019 and 2020, the Netherlands was one of the nations best prepared for large-scale AV deployment in the world. One major factor in the Netherlands’ preparedness for AVs is that the country has established several policies to help move the needle on AV research and deployment. For example, the Dutch government announced in 2019 that it was developing a “driving license” for AVs that would permit the government to set standards and certify autonomous models for road use. The Dutch Vehicle Authority also has a clear process to issue an exemption for self-driving vehicles to operate on roads after companies seeking to test them demonstrate their safety and submit a formal application. In regards to legislation, the Experimenteerwet zelfrijdende auto (or law governing the experimental use of self-driving vehicles) was passed in 2018, legalizing monitored unmanned AV testing on public roads – previously a driver or safety operator was required to be present in the vehicle. The Dutch, German, and Belgian governments are also collaborating on truck platooning programs along cross-border corridors.

- United Kingdom (UK): In 2015, the UK established its Centre for Connected and Autonomous Vehicles, part of the Departments for Transport and for Business, Energy & Industrial Strength. This Centre conducts research regarding AVs, and it provides funding for projects to develop understanding of vehicle technologies, communications, data security and infrastructure, among other research areas. The Law Commission of England and Wales is also working with the Scottish Law Commission to develop a comprehensive regulatory framework for AVs; this three-year project concluded in January 2022 with the delivery of a final legal framework recommendation report.

- Finland: In 2017, the Finnish Ministry of Transport and Communications passed the three-phase Act on Transport Services, the objective of which was to accelerate digitalization of the transport sector and facilitate more streamlined regulations. Part of this act involved permitting the use of remote controlled vehicles. Finland’s revised Road Traffic Act, which went into effect in June 2020, also serves to reduce regulatory burdens, as well as to better integrate data from existing infrastructure like roads signs and lights for AV operation. The Act also provides for the Ministry of Transport and Communications to repaint the country’s yellow dividing lanes on roads to white to better facilitate AV deployment.

- Germany: In 2018, Germany passed ethical regulations for AVs, developed by the Ethics Commission of the Federal Ministry of Transport and Digital Infrastructure. Some components of the report include the guideline that human life should always be prioritized over property, and that driverless cars should utilize technology similar to blackboxes on airplanes to determine causes of accidents.

- Singapore: This city-state is one of the global leaders in city-level AV policy development. In early 2019, Singapore’s Land Transportation Agency (LTA) published Technical Reference 68, which is a set of provisional standards for AV deployment focusing on vehicle behavior, vehicle functional safety, cybersecurity, and data formats. In 2017, the Singaporean government opened the Centre of Excellence for Testing and Research of Autonomous Vehicles at Nanyang Technological University, which helps researchers gather data and explore the impacts of factors such as traffic lights, hills, and rain on AV travel. Some autonomous shuttles and buses are being tested on public streets.

- United States: At the federal level, the US National Highway Traffic Safety Administration (NHTSA), an agency of the USDOT, has taken the lead regarding research and AV guidance. In September 2016, the USDOT published the Federal Automated Vehicles Policy, and the following year, it released the Automated Driving Systems: A Vision for Safety 2.0 (ADS 2.0), which is a non regulatory approach to help auto manufacturers and operators approach deployment of AVs Level 3-5. Preparing for the Future of Transportation: Automated Vehicles 3.0 (AV 3.0) was released in 2018, which expands the scope of the ADS 2.0 report, aims to reduce policy uncertainty, and outlines a process for working with the USDOT. The agency published its latest report, Ensuring American Leadership in Automated Vehicle Technologies: Automated Vehicles 4.0 (AV 4.0) in January 2020. In addition, the federal government encourages companies to submit annual voluntary safety self-assessments, which can be found here.

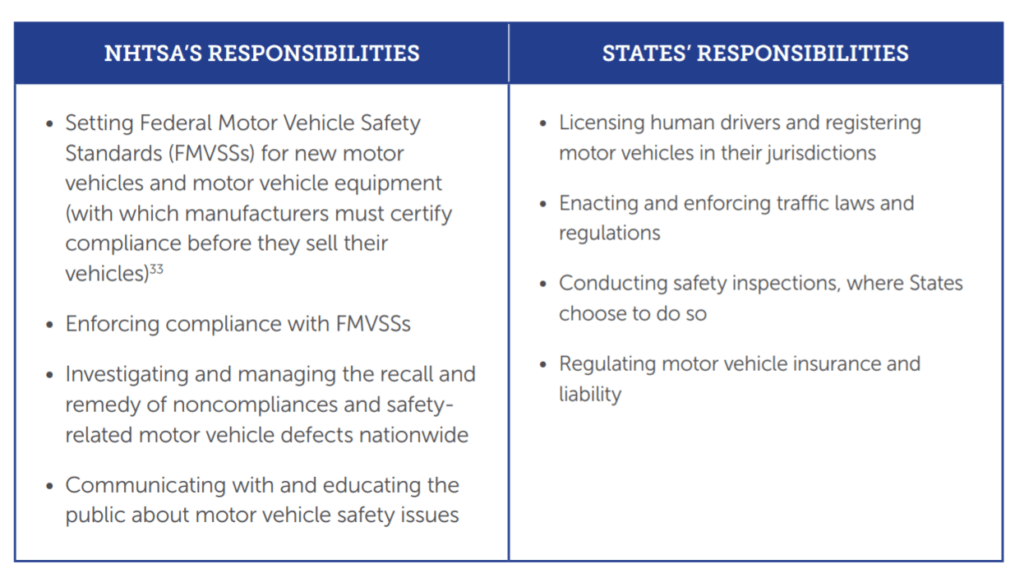

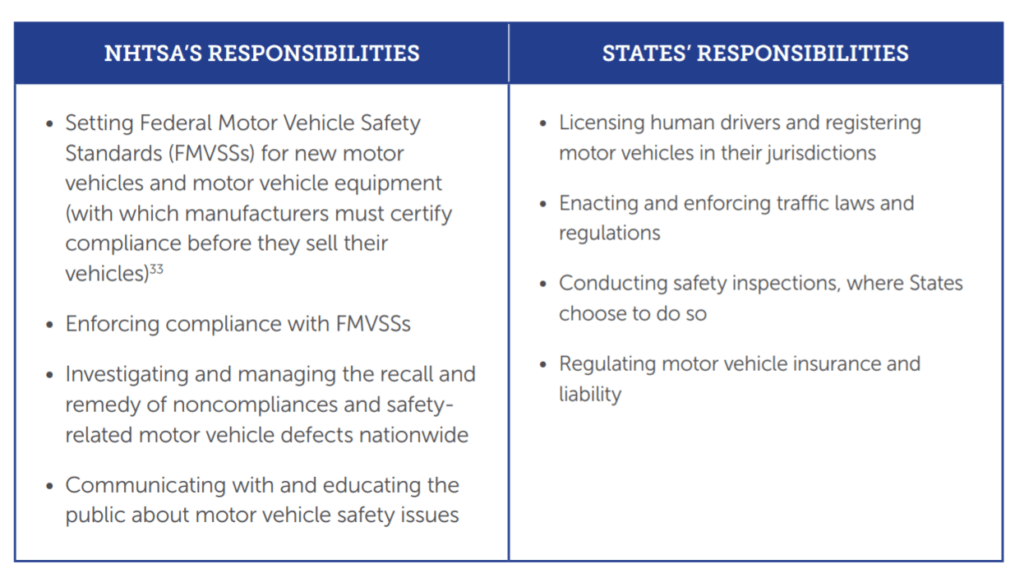

NHTSA is responsible for establishing the Federal Motor Vehicle Safety Standards (FMVSS), and companies are then tasked with certifying that they meet those standards. When a passenger was injured on board an EasyMile autonomous shuttle during an emergency stop in 2020, it was NHTSA that stepped in to temporarily prohibit all programs around the country using this vendors’ shuttles from transporting passengers. Despite this move, NHTSA’s approach to regulation has been relatively relaxed compared to other developed nations; according to the National League of Cities, the agency has embraced a “permissive environment marked by regulatory restraint and heavy trust in AV developers.”

Several companies have encouraged NHTSA to revise its existing vehicle safety standards so that different standards apply to AVs that have no manual controls; currently, the FMVSS specify 73 standards that must be present on vehicles to be sold in the US, but many Level 4 or 5 AVs would not comply with standards relating to steering wheels, brake pedals, and other human-centric requirements. NHTSA issued its first autonomous vehicle exemptions to those standards in February 2020 to California-based Nuro, whose autonomous package-delivering vehicle was ruled exempt from three federal motor vehicle standards.

Historically, federal agencies were largely responsible only for establishing requirements for vehicle standards pertaining to safety and equipment. As a result, much was left to the discretion of individual states regarding how to best regulate other matters, including licensing, insurance, liability, traffic law, and safety inspections. The above chart from the NHTSA’s ADS 2.0 report clarifies how the federal government has allocated these regulatory responsibilities in the past. Some NHTSA reports have provided recommendations to states on how to best manage driver regulation and other AV-related issues, but such recommendations remain nonbinding, and there are some who believe the federal government should take a larger role in regulating AVs than they have previously in regulating non-automated travel. Congress has attempted to pass national AV legislation, but such efforts have failed to gain consensus on issues ranging from the appropriate federal role in driver management to cybersecurity concerns. An overview of such issues is detailed in the Congressional Research Service’s February 2020 report, Issues in Autonomous Vehicle Testing and Deployment.

Source: NHTSA; current assignment of roles and responsibilities between NHTSA and states pertaining to vehicle safety standards. https://www.nhtsa.gov/sites/nhtsa.dot.gov/files/documents/13069a-ads2.0_090617_v9a_tag.pdf

Examples of US State Level Policies & Programs:

- Arizona: In 2015, the Governor of Arizona issued an executive order establishing the state’s Self-Driving Vehicle Oversight Committee and supporting the testing and operation of self-driving vehicles. The Governor issued a second executive order in 2018 permitting the use of AVs on Arizona roads without a person present behind the wheel. To date, more than a dozen companies have conducted AV-related tests in Arizona, including Waymo, Intel, Uber, and GM, taking advantage of the supportive testing environment and clear weather. Companies seeking to test or operate AVs must first submit AV Testing Statement and Certification to the Arizona DOT, which has outlined step-by-step requirements for testing with and without human drivers.

- California: In 2012, California became the third state (after Nevada and Florida) to legalize AVs on state roads through SB 1298. In 2016, the state passed AB 1592, which authorized the Contra Costa Transportation Authority to launch an AV pilot project. The law included some stipulations, including that AVs operate at speeds less than 35 miles per hour. Through an Adoption of Regulations in 2018, the California Department of Motor Vehicles also established procedures and requirements to which companies need to adhere in order to conduct testing and operation on state roads. For example, the state has an AV Testing Program for testing programs with a driver, an AV Testing Program for programs without a driver, and an AV Deployment Program. A special permit is also required for companies seeking to collect revenue from AV programs.

- Florida: In 2012, Florida passed legislation permitting AVs, making it just the second state to do so behind Nevada, and in June 2018, the Governor signed into law new legislation that was intended to make Florida an attractive testing ground for AV companies. The law permits testing of fully autonomous cars without a human safety driver present with limited restrictions, and the law does not require an additional permit to collect revenue from passengers. The state is also investing in SunTrax, its AV testing facility near Orlando.

- Oregon: In April 2018, the Oregon DOT was named the state’s lead agency regarding AVs, and it established the Oregon Task Force on Autonomous Vehicles. The task force consists of law enforcement representatives, legislators, cybersecurity experts and transportation sector professionals, among others, and its objective is to develop recommendations for automated vehicle legislation. In September 2018, the task force submitted to the Oregon legislature its first report with its recommendations for AV-related legislation. This report explored matters pertaining to licensing and registration, law enforcement and crash reporting, cybersecurity, and insurance and liability. In September of 2019, the task force submitted its second report, which focused on land use, road and infrastructure design, public transit, workforce changes, and state responsibilities relating to cybersecurity and privacy.

- Washington: In May 2017, the Governor of Washington signed an executive order encouraging AVs on public roads. Companies seeking to test AVs in the state henceforth needed certification from the Department of Licensing. However, there has been some criticism that the Departments’ requirements to allow testing are insufficient, and that there is no data sharing requirement, meaning the Department does not have information on how many cars are being tested at any given time among those currently permitted. In 2018, the state also established the Washington State Autonomous Vehicle Work Group, which aims to prepare legislation for AV deployment. The group’s 2021 annual report is available here. More generally, Washington state’s Commute Trip Reduction Law – initially passed in 1991, with various updates in subsequent years – sets certain standards for how employers and employees must work together to reduce the number and length of drive-alone commute trips made to their worksite. The policy defines single-occupancy trips to include certain types of ridehailing, and promotes the most effective trip-reduction strategies. Such approaches will be extremely helpful to ensure that the adoption of AVs increases mobility and shared rides, rather than facilitates greater single-occupancy travel and greater VMT.

- Additional resources for decision-makers and planners at the state level:

Considerations at the City Level:

Cities have a wide range of authority to enact laws that might impact AV operations and deployment. For example, some cities may choose to prohibit AVs in school zones or require certain data-sharing practices from operators. One issue that will likely be of increasing concern to cities is the extent to which state and federal laws might preempt such authority. Just as some states have prohibited the local regulation of TNCs, states might also opt to regulate AV-related matters, thereby blocking cities to address concerns as they might otherwise choose. Cities should proactively work with state and federal legislators to ensure their authority to manage AV operations in uniquely urban contexts.

Additional resources for decision-makers and planners at the city level:

- Bloomberg Philanthropies & The Aspen Institute, Initiative on Cities and Autonomous Vehicles

- National League of Cities, Autonomous Vehicle Pilots Across America: Municipal Action Guide, 2018

- National League of Cities, Autonomous Vehicles: A Policy Preparation Guide, 2017

- National League of Cities, City Rights in an Era of Preemption: A State-by-State Analysis, 2017

- World Economic Forum, Reshaping Urban Mobility with Autonomous Vehicles: Lessons from the City of Boston, 2018

- Denver RTD, 61AV Autonomous Shuttle Demonstration Project Final Report, Denver, CO, 2019

- Urbanism Next Center, New Mobility in the Right-of-Way, 2019

- Arlington, TX, Milo Pilot Program Closeout Report

- University of Michigan, Mcity Driverless Shuttle Case Study

- Federal Transit Administration, An Evaluation of the Valley Metro-Waymo Automated Vehicle RideChoice Mobility on Demand Demonstration, 2021

Previous Subsection Next Subsection

References

34. Bloomberg: “Ford CEO Tamps Down Expectations for First Autonomous Vehicles”, published April 9, 2019. https://www.bloomberg.com/news/articles/2019-04-09/ford-ceo-tamps-down-expectations-for-first-autonomous-vehicles.

35. Victoria Transport Policy Institute: “Autonomous Vehicle Implementation Predictions: Implications for Transport Planning”, published March 3, 2022. https://www.vtpi.org/avip.pdf.

36. Society of Actuaries: “An Update on the Outlook for Automated Vehicle Systems”, published October 2019. https://www.soa.org/globalassets/assets/files/resources/research-report/2019/automated-vehicle-update.pdf.

37. Society of Actuaries: “An Update on the Outlook for Automated Vehicle Systems”, published October 2019. https://www.soa.org/globalassets/assets/files/resources/research-report/2019/automated-vehicle-update.pdf.

38. WIRED: “The Feds Ban a Self-Driving Shuttle Fleet from Carrying People”, published February 29, 2020. https://www.wired.com/story/feds-ban-self-driving-shuttle-fleet-carrying-people/?bxid=5cec24fbfc942d3ada068985&cndid=57041884&esrc=DailyNLPromo?utm_ter&source=EDT_WIR_NEWSLETTER_0_TRANSPORTATION_ZZ&utm_brand=wired&utm_campaign=aud-dev&utm_mailing=WIR_Transportation_030220&utm_medium=email&utm_source=nl&utm_term=WIR_Transportation.

39. Office of the City Manager, City of Vancouver: “Memo – Smart Cities Challenge Joint Application”, submitted on March 4, 2019. https://vancouver.ca/files/cov/2019-03-04-smart-cities-challenge-joint-application.pdf.

40. Transport Policy: “The Autonomous Vehicle Parking Problem”, published March 2019. https://www.sciencedirect.com/science/article/abs/pii/S0967070X18305924.

41. Urbanism Next, University of Oregon: “Changing Parking Infrastructure with Autonomous Vehicles”, published May 9, 2018. https://urbanismnext.uoregon.edu/category/inputs/ownership/.

42. Bloomberg: “Why Speed Kills Cities”, published August 8, 2019. https://www.bloomberg.com/news/articles/2019-08-08/lower-speed-limits-could-save-your-city-and-life.

43. National Association of City Transportation Officials: “Blueprint for Autonomous Urbanism: Second Edition”, published September 2019. https://nacto.org/publication/bau2/transit/.

44. Law Commission of England and Wales, Scottish Law Commission: “Automated Vehicles: Joint Report”, published January 26, 2022. https://www.lawcom.gov.uk/project/automated-vehicles/.

45. Government of the Netherlands: “Self-Driving Vehicles”. https://www.government.nl/topics/mobility-public-transport-and-road-safety/self-driving-vehicles. Accessed April 4, 2022.

46. Centre for Connected and Autonomous Vehicles: “UK Connected & Autonomous Vehicle Research & Development Projects 2018”, published September 2018. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/737778/ccav-research-and-development-projects.pdf.

47. Law Commission of England and Wales, Scottish Law Commission: “Automated Vehicles: Joint Report”, published January 26, 2022. https://www.lawcom.gov.uk/project/automated-vehicles/.

48. Land Transport Authority, Government of Singapore: “Joint Media Release by the Land Transport Authority (LTA), Enterprise Singapore, Standards Development Organisation & Singapore Standards Council – Singapore Develops Provisional National Standards to Guide Development of Fully Autonomous Vehicles”, published January 31, 2019. https://www.lta.gov.sg/content/ltagov/en/newsroom/2019/1/2/joint-media-release-by-the-land-transport-authority-lta-enterprise-singapore-standards-development-organisation-singapo.html.

49. National League of Cities: “Autonomous Vehicle Pilots Across America: Municipal Action Guide”, published 2018. https://www.nlc.org/wp-content/uploads/2018/10/AV-MAG-Web.pdf.

50. RAND Corporation:”Autonomous Vehicles and Federal Safety Standards: An Exemption to the Rule?”, published 2017. https://www.rand.org/content/dam/rand/pubs/perspectives/PE200/PE258/RAND_PE258.pdf.

51. Congressional Research Service: “Issues in Autonomous Vehicle Testing and Deployment”, published April 23, 2021. https://crsreports.congress.gov/product/pdf/R/R45985.

52. Government Technology: “Washington State in the Dark Over Public AV Testing”, published September 23, 2019. https://www.govtech.com/fs/automation/washington-state-in-the-dark-over-public-av-testing.html.

Previous Subsection