Federal Resources

Federal funding often sources a large portion of the capital and operations funding for shared mobility projects. Numerous federal agencies provide grants and other programs that involve funding options. These are typically competitive, require documentation of the project need, costs and benefits, and need dedicated staff to manage grant administrative duties. On November 15, 2021, President Biden signed the Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law, which will bring forth billions of dollars in competitive funding available to cities, towns, and entities across new and existing programs. These new and existing competitive grant programs not only address transportation but also bring a renewed focus to climate, energy, and the environment. The law also further increases the amount of formula funding that will be designated to states, cities and local governments, greatly expanding the flexibility of funds under programs like the Surface Transportation Block Grant. For those specifically interested in transit funding, the Center for Transportation Excellence has outlined the transit ballot measures for each election since 2012, including the total revenue and the percentage breakdown of revenue types and where the funds would be allocated for each ballot measure, if passed.

When it comes to transportation, there are three main agencies that offer federal funding opportunities. These include:

These entities offer competitive grants and programming for transportation improvements that support innovative mobility, reduce traffic congestion, improve air quality, and enhance access. The US Department of Energy’s Office for Energy Efficiency and Renewable Energy (EERE) provides an additional resource to advance sustainable mobility by providing funding opportunities for electric vehicles and charging infrastructure.

Outside of the typical grant programs offered under these entities, the COVID-19 pandemic has brought forth emergency relief funding programs established by the federal government to support mobility services, including those that are shared-use. For instance, the Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $25 billion to transit agencies across the country to support the continued operation of essential transportation services and other related expenses during the pandemic.

Next Subsection

Formula Grant Programs

Formula grants are non-competitive grants awarded to recipients who are predetermined. These grants are usually administered and managed by State Administering Agencies and the amount of funds are allocated to recipients based on a formula often set by governmental legislation and regulations. This legislation specifies eligibility requirements and how the funds will be distributed among eligible recipients. A local match of 20% is often required.

The Surface Transportation Block Grant Program (STBG) was reauthorized under the Surface Transportation Reauthorization Act of 2021 to now include funding for electric vehicle charging infrastructure and vehicle-to-grid infrastructure.

Capital Investment Grants Program (Section 5309): This FTA discretionary grant program provides funding for transit capital investments, including heavy rail, commuter rail, light rail, streetcars and bus rapid transit. Under the IIJA, $8 billion of the newly allocated $23 billion will be used to invest in new high-capacity transit projects that communities choose to build.

Enhanced Mobility of Elderly and People with Disabilities (Section 5310): This program provides funding for projects aimed at improving mobility for seniors and people with disabilities in all size markets. Found in 49 U.S.C. Chapter 53, Section 5310, reauthorized under FAST Act.

Formula Grants for Rural Areas (Section 5311): This program provides capital, planning and operating assistance to states that support public transportation in rural areas (populations less than 50,000).

Urbanized Area Formula Grant (Section 5307): This FTA program allocates Section 5307 funds as subsidies to eligible public transit agencies to use for capital equipment (buses, equipment, structures, etc.), planning, job access and reverse commute projects, mobility management, and some limited operating expenses related to the federally required assistance transit agencies must provide to persons with disabilities. This grant program was used by the City of Valdosta to sustain operations of Valdosta On-Demand, an on-demand microtransit service in Valdosta, GA that was initially funded through the CARES Act.

National Rural Transit Assistance Program (RTAP): This program, housed under the FTA, provides resources, technical assistance, and partner collaboration for rural transit initiatives.

The Congestion Mitigation and Air Quality Program (CMAQ) helps fund transportation projects that seek to reduce transportation related carbon emissions. CMAQ is often administered by local Metropolitan Planning Organizations, is used in nonattainment areas, and is often a popular funding mechanism to help support bikeshare programs. Under the recently passed IIJA, funds under CMAQ can now be used for shared micromobility, including bike share and shared scooter systems, as well as for the acquisition of medium- or heavy-duty zero emission vehicles and electric charging infrastructure.

The National Electric Vehicle Formula Program: This program, established under the IIJA and spearheaded by the Department of Transportation, dedicates $5 billion to states for the deployment of EV infrastructure including its operations and maintenance. The funding also establishes the Office of Energy and Transportation, a collaboration between the Department of Transportation and the Department of Energy to coordinate work on electric vehicle infrastructure.

Previous Subsection Next Subsection

Competitive Grant Programs

Competitive Grants, also known as discretionary funding, are awarded based on a competitive process, which includes preliminary review to determine eligibility and a proposal selection where applications are reviewed and scored by an established panel. These grants are only awarded to a select few entities.

Grants for Buses and Bus Facilities Formula Program (Section 5339): The Grants for Buses and Bus Facilities Formula Program provides funding to states and designated recipients to replace, rehabilitate, and purchase buses and related equipment as well as construct or modify bus related facilities. The Low- or No-Emission Vehicle Program, a subprogram under this initiative, provides funding for bus and bus facility projects that support low and zero-emission vehicles.

The Alternative Fuel Corridor Grant Program: This program, established under the IIJA, funds investments along the Alternative Fuel Corridors that states have already been working on. The program looks to get publicly accessible electric charging infrastructure implemented along alternative fuel corridors.

Public Transportation Innovation (5312): This FTA federal funding program provides funding to develop innovative products and services assisting transit agencies in better meeting the needs of their customers. Eligible projects can focus on facilitating the deployment of research and technology development, the implementation of research and technology development to advance the interests of public transportation, or the deployment of low or no emission vehicles and associated technology.

FTA Mobility Innovation

Mobility innovation initiatives, under the FTA, supports innovative pilot projects to experiment new mobility services and technologies. Past and ongoing funding opportunities include the MOD Sandbox, MOD On-Ramp, Integrated Mobility Innovation (IMI), and Accelerating Innovative Mobility (AIM), and Enhancing Mobility Innovation of which are described below.

- FTA Mobility-on-Demand On-Ramp: Public agencies that applied for and were selected for this program received free technical assistance to develop innovative mobility on-demand projects. For example, a collection of public agencies and community groups in Tompkins County, NY were selected for this program to support efforts to build a trip planning and booking platform housing all the various transportation services in Ithaca and the surrounding rural communities.

- FTA Mobility-on-Demand Sandbox Program: This FTA grant program was launched in 2016 and provided nearly $8 million in financial support to public agencies pursuing innovative mobility on-demand projects. Eleven projects were awarded grants, including the Vermont Agency of Transportation’s project to develop a state-wide trip planning platform that included results for flexible forms of on-demand transportation. A case study on the Vermont project is available here.

- Integrated Mobility Innovation Program: This FTA funding opportunity provided $15 million in 2019 to projects focused on MOD, strategic transit automation research or mobility payment integration. See a list of the shared mobility projects piloted through this program on the Mobility Innovation Collaborative Website.

- Accelerating Innovative Mobility Program: This FTA grant initiative provided $14 million in 2020 to projects that support and advance innovation in the transit industry while addressing access and equity. Projects included approaches that improved transit financing, planning, system design, and service. See a list of the shared mobility projects piloted through this program on the Mobility Innovation Collaborative Website.

- Enhancing Mobility Innovation: This FTA grant opportunity is providing $2 million in FY 2021 funds for projects that advance safe, reliable, equitable, and accessible services that support complete trips for all travelers. Projects under this program fall under two categories: Accelerating Innovative Mobility and Software Solutions. The program promotes technology projects that center the passenger experience such as integrated fare payment systems.

- Accessible Transportation Technology Research Initiative: This initiative is a joint program between the USDOT, the Federal Highway Administration, FTA, and Intelligent Transportation Systems Joint Program Office. It aims to conduct research, development, and education activities to facilitate the adoption of information and communication technology into transportation initiatives.

Access and Mobility Partnership Grants

Access and Mobility Partnership Grants, under the FTA, look to improve access to public transportation by building partnerships among health, transportation, and other service providers.

- Innovative Coordinated Access and Mobility (ICAM): This pilot program provides funding to support innovative projects for the transportation disadvantaged that will improve the coordination of transportation services and non-emergency medical transportation services (NEMT).

- Human Services Coordination Research Program (HSCR): The HSCR program funds operating and capital project expenditures to develop and implement projects that improve coordinated human services transportation for targeted populations.

Previous Subsection Next Subsection

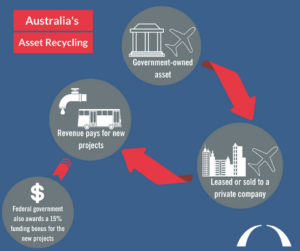

State Resources

State funding typically stems from tolls, taxes, bonding and debt, state DMV fees, state grants, and transportation budgets. In the State of California, the California Air Resources Board (CARB) offers opportunities to fund shared mobility solutions through programs like Clean Mobility Options Voucher Pilot Program and the Sustainable Transportation Equity Project (STEP). Other states, like Michigan and Minnesota, have put out grant opportunities through their DOT’s to advance shared mobility and transportation innovation. These funding sources vary from one-time opportunities to programs that see on-going investment each year.

Many state funding programs and opportunities related to transportation can be found on state agency websites, specifically those dedicated to the departments of transportation, economic development, and the environment. States like Michigan have established dedicated mobility offices through partnerships between state agencies creating a one stop shop for interested parties to catch up on the latest mobility news, events, and funding opportunities. Michigan’s Office of Future Mobility and Electrification works across state government, academia and private industry to develop dynamic mobility and electrification policies and support the development and implementation of emerging mobility trends. In addition, the National Conference of State Legislatures provides a transportation funding and finance state bill tracking database offering real-time information about transportation funding and finance bills that have been introduced in the United States.

Examples of State Programs and Funding Opportunities

- Clean Mobility Options is a program directing $32 million in funding and capacity-building to disadvantaged communities deploying zero-emission carsharing, carpooling/vanpooling, bikesharing/scooter-sharing, innovative transit services, and ride-on-demand services.

- Sustainable Transportation Equity Project (STEP) is a pilot program that provides planning and implementation grants to projects that utilize shared mobility services as an avenue to improve community residents’ access to key destinations and reduce greenhouse gas emissions.

- The Michigan Mobility Challenge Grant Initiative directed $8 million in funding towards projects designed to address mobility gaps for seniors, persons with disabilities. Project selections commonly involved improved transit accessibility and the development of integrated trip platforms.

- The Minnesota Department ofTransportation’s CAV Challenge is an innovative request for proposals that seeks to leverage emerging technologies to improve transportation. This open and rolling procurement process allows public and private entities to propose CAV solutions that address safety, efficiency, equity, outreach and mobility. MnDOT has met with over 52 vendors, reviewed 28 proposals and awarded 8 projects, one of which was the Rochester Automated Shuttle Service Pilot.

- The Washington State Department of Transportation’s First Mile/Last Mile Connections Pilot Grant Program supports projects that help people connect with fixed-route public transportation services. Eligible projects included those that focused on coordination between shared mobility services like bikeshare and carshare and public transportation.

- In 2020, the Massachusetts Department of Transportation Workforce Transportation Grant Program provided $4.2 million to municipalities, business organizations, Regional transportation authorities, and other entities to offer additional commuting options to their employees that would encourage a shift away from single-occupancy vehicle use, increase access to jobs and reduce greenhouse gas emissions. The Worcester Regional Transit Authority (WRTA) in Westborough, MA received a $460,000 grant through this program to help launch Via WRTA, an affordable on-demand shuttle service operated by Via.

Previous Subsection Next Subsection

Local Resources

Local public funding can show the private sector the local government’s commitment in a public/private business model. Local funds are often used towards capital costs rather than operational costs because operating expenses are more likely to fluctuate [1]. Since federal grants often require a local match of 20%, finding local funding is essential to securing grants and implementing transportation related services and improvements [1].

Regional governmental entities such as MPOs may administer programs that award local funding to projects supporting improved transportation access and liveable communities. For instance, Regional Transportation Authority (RTA), a unit of local government created to oversee finances, to secure funding, and to conduct transit planning for the Chicago Transit Authority (CTA), Metra, and Pace, established the Access to Transit program in 2012. This program awards funding to small-scale capital projects that improve pedestrians’ and bicyclists’ access to public transportation, including micromobility projects.

Local funding can come from a variety of sources including:

- taxes (income, general sales, and property)

- parking revenue

- tollway revenue

- congestion pricing revenue

- subsidies

- leveraging budgets from other projects

- distribution of license plate fees

- public grants

Taxation is one of the most common ways cities, towns, and municipalities finance local infrastructure projects. General taxes, such as sales tax, property tax, and local income taxes often finance local street improvements, transit, etc, however, more communities are leveraging local option taxes as a way to raise funds for specific projects. Local option taxes are new tax options that fund infrastructure related improvements through state level authorization or local voter approval at the county or municipal level. This sort of tax option was utilized by the Missoula Urban Transportation District to finance service expansion of the local transit network.

Other opportunities include leveraging funding associated with construction and development. While dependent upon the location of transportation improvements or development projects, development impact fees, special assessments, and funding directly from developers can support site-specific or general investment in shared mobility infrastructure and services.

- Development Impact Fees are fees applied to new development that pay for capital improvements needed to accommodate transportation demand.

- Special Assessments are taxes local government levies on property owners because of the benefits their property will receive as a result of a public transportation improvement

- Joint Development is an arrangement between local governments and private developers where private developers jointly share costs of infrastructure improvement with local governments. It is a value-capture mechanism commonly used by local transit agencies.

- Developer Funding is an opportunity to align shared mobility projects with private developers who often hold the key to necessary funding. Shared mobility projects could be incorporated into residential and/or commercial developments pursued by developers. This offers the developer community-driven publicity and marketing as well as widespread impact, and offers the transit agency or nonprofit the funding required to develop the project. Additionally, there is the potential for private developers to contribute to a shared mobility project if it is part of a trip mitigation or travel demand strategy. Discussed earlier in this document, the Wheels2U microtransit program partnered with the local developer to provide on-demand service in the downtown and the local mall.

Additionally, establishing or leveraging existing tax districts, such as Tax Increment Financing (TIFs), can raise revenue for both large and small transportation projects. In the City of Chicago, local TIF Districts have allocated funds to support the installation of Divvy stations and bikes within their boundaries. In San Francisco, TIF financing is supporting the redevelopment of the Transbay Transit Center, a multimodal transportation hub.

Previous Subsection Next Subsection

Flex-Funding

Transit agencies can flex funds from a huge array of federal highway programs to fund transit supportive infrastructure. Flex funding allows investments in any pedestrian project within a half-mile of a fixed-route transit stop and any bicycle infrastructure project within three miles of a fixed-route transit stop to maximize transit supported infrastructure and improve transit access. Under U.S. Federal Code, funds from Federal Highway programs can be transferred for public transportation projects so that administrative duties are assigned to the FTA. Flexible funding allows entities to make much needed transit, pedestrian, and bicycle improvements within their transportation networks, however, funding still has to be secured through the regular calls for projects. Eligible programs for flex funding include but are not limited to the Congestion Mitigation and Air Quality (CMAQ) program as well as the new Carbon Reduction Program that arose from the recently passed bipartisan Infrastructure Investment and Jobs Act.

Previous Subsection